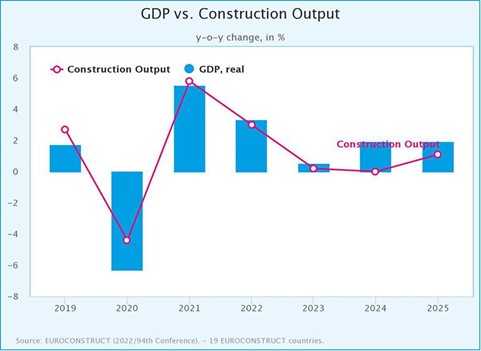

EUROPE

Euroconstruct estimates +3% growth in construction output in Europe in 2022 but revises its forecast for 2023-2024 downward.

Europe's construction sector faces a two-year period with almost zero growth forecasts: +0.2% in 2023 and 0% in 2024.

Much of the negative outlook is driven by the new residential and renovation sectors, which are suffering from rising interest rates. Indeed, buying and selling has slowed over the past six months causing an oversupply in all countries. Keeping pace is only civil engineering thanks to investments in low-carbon clean energy that require infrastructure upgrades.

USA

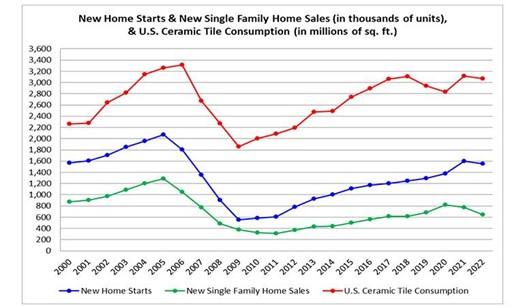

In 2022, U.S. residential construction experienced its first decline in 15 years, with 1.56 million new housing units, down 2.9% on 2021. Negative forecasts for 2023 as well. U.S. residential construction in 2022 has been slowed by rising mortgage rates and inflation, as well as supply chain problems and labor shortages.

According to forecasts by the National Association of Home Builders (NAHB), in 2023, both the single-family housing and condominium segments are expected to mark a sharp decline, by 26 percent and 28 percent, respectively.

In this difficult scenario in 2022, tile consumption dropped 1.3 percent to 285.4 million sq. m., as did imports, which lost 2.3 percent, stopping at 202.7 million sq. m. Domestic production increased, reaching 87.3 million sq. m.

Prices, on the other hand, due to the geopolitical situation, experienced very high increases: the average selling price of domestic product rose from $16.61/sqm in 2021 to $17.86/sqm in 2022, while those of imports experienced double-digit increases: Italian tiles remained the ones with the highest value, amounting to $25.36/sqm, up 15.7% from $21.92/sqm in 2021. The average price of Spanish tiles increased by 42.6 percent from $13.77/sqm to $19.64/sqm.

RELATIONSHIP BETWEEN U.S. TILE CONSUMPTION AND NEW HOME STARTS AND SALES

By value, "Made in USA" tile sales in the domestic market generated revenues of $1.48 billion (+8.6% over 2021), or 33.4% of the total value of the U.S. ceramic market, up from 35.2% in 2021

In 2022, tile imports reached a value (CIF & Duty) of $2.94 billion, an advance of 17.5% over 2021. Major exporter by value was once again confirmed asItaly ($888.6 million, +12.4%) with a 30.2% share of the total; followed by Spain ($789 million, +24.5%) with a 26.8% share, and Mexico ($267 million, +9%).

U.S. tile exports also grew, rising to 4.7 million sq m (+33.6% over 2021).

ITALIAN CERAMIC INDUSTRY

The ITALIAN Ceramics Industry is holding up well in 2022, closing the year on a positive note both in terms of production volumes (+3%) and revenues (+16.4%) and, despite the fact that the second half of 2022 has shown a tangible slowdown in global demand, at the moment there are no signs that the negative phase is about to worsen, on the contrary, says Giovanni Savorani, President of Confindustria Ceramica in an interview with CWR, "according to several entrepreneurs in the sector, this slowdown could last until June and then return to a situation of normalization. In the meantime, companies that had emptied their warehouses are replenishing them, while on the orders front we record the maintenance of good levels even in the first two months of 2023."

According to the pre-consensus presented by Confindustria Ceramica last December, the Italian ceramic tile industry closed 2022 with an increase in production volumes(448 million sq m, +3%), total sales(458 million sq m, +0.7%) and exports(364 million sq m, +0.2%) compared to 2021; volumes, moreover, all above pre-covid levels in 2019. In terms of revenues, the sector hit a new record, the result, however, only of the general rise in list prices to compensate for the sharp increase in all production costs: total revenues grew +16.4%, from €6.2 billion in 2021 to around €7.2 billion, with total average price rising from €13.5/sqm to around €15.7/sqm and export price from €14.3/sqm to €16.7/sqm.

As is well known, the most dangerous challenge has been the explosion in energy prices, which, according to Confindustria Ceramica's calculations, has resulted in an increase in expenses for companies in the sector of more than €1 billion for the thermal component alone. Higher costs recovered, in addition to intervening on prices, also thanks to government incentives in the form of energy and gas tax credits.

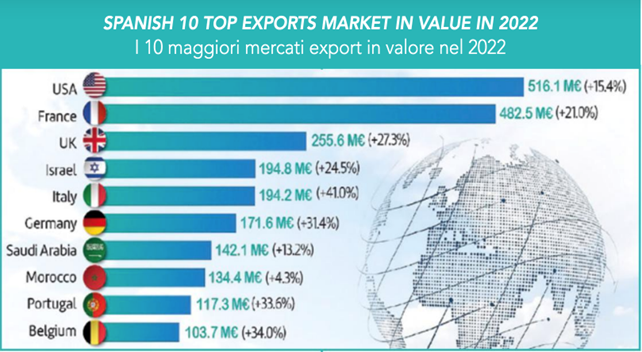

SPANISH CERAMIC INDUSTRY

On the other hand, the Spanish ceramics industry is in trouble, which, despite the sharp increase in selling prices, is unable to recover the higher costs of energy and raw materials and closes the year in deep trouble, as Ascer president Vicente Nomdedeu reminds CWR "we have more than forty kilns at a standstill, and in the six months from July 2022 to January 2023 we lost 1,017 jobs, to which must be added the employees who, on a rotating basis, are subject to ERTE (the Spanish layoff fund)."

In 2022, Spanish ceramic tile production dropped 15 percent from 587 to 500 million sq. m., total volume sales lost 13 percent, with a similar decline in both the domestic and export markets , where volumes fell from 496 million sq. m. in 2021 to about 432.

Not even the increase in the sector's turnover (+16.2% to €5,538 million, some €770 million more than 2021), the only positive figure, cheers entrepreneurs more than a little, as it is driven solely by the increase in sales prices with which Spanish ceramic companies have tried to compensate (unfortunately only partially) for skyrocketing production costs due to the energy component. With the added aggravation of undermining the sector's competitiveness in international markets at a time of, among other things, slowing demand.

President Nomdedeu does not hide his concern when, numbers in hand, he illustrates the extent of the problem: "The cost of gas is now the highest item in our industrial cost structure, its price multiplied by 10. The total energy bill (gas + electricity) of our industry has risen from €939 million in 2021 to €2,235 million in 2022, or 40% of turnover: we are talking about €1,300 million more, only partly recovered with the rise in price lists. The impact has been very serious and so far the companies have borne the cost burden alone, but the consequences are there for all to see: we are coming from 10 consecutive months of declining production (December 2022 and January 2023 marked -25% and -30% month-on-month, respectively); we have more than forty or so stopped furnaces and in the six months from July 2022 to January 2023 we have lost 1,017 jobs, to which we must add the employees who, on a rotating basis, are subject to ERTE (the Spanish layoff fund)."

Despite export data confirming a loss of competitiveness for Spanish tile, Nomdedeu ressta confident: "Recovering lost ground will not be easy, but if government aid arrives and the price of gas continues to fall we are confident we can make it and as early as this year we could recover a 5% share of production coming in at 520 million sq. m."