In 2023, India's population surpassed China's for the first time, driving the country's economic growth.

With GDP estimated at +6.1 percent this year and +6.8 percent in 2024, India is distinguishing itself by its dynamism and speed of economic growth.

Growth in 2022 was 6.9%, driven by strong government investment and growth in domestic consumption, particularly in the luxury sectors.

Inflation remains high at 6.7 percent, but is expected to decline to 5.2 percent in 2023-2024.

The slight reduction in growth in 2023 is due to a slowdown in growth in domestic consumption due to inflation and rising commodity and energy costs, and government investment will also have a decrease after the end of the pandemic.

It still remains one of the world's fastest growing economies.

"The Indian economy continues to show strong resilience to external shocks," said Auguste Tano Kouame, World Bank country director in India. "Despite external pressures, India's services exports have continued to increase and the current account deficit is narrowing."

Finally, Indian banks are in excellent health and remain well capitalized, supported by improving asset quality and robust private sector credit growth.

India, therefore, is beating all other countries in dynamism and speed of economic and social growth (in 2023 it will surpass China in terms of population), two prerequisites that are fundamental to projecting wide margins of development for the construction sector, both public and private, and infrastructure, and thus for the consumption of building materials, including ceramics.

The MECS study center, in its recent research, calculated a total production potential for the Indian ceramic industry that already exceeds 3.7 billion sq. m.

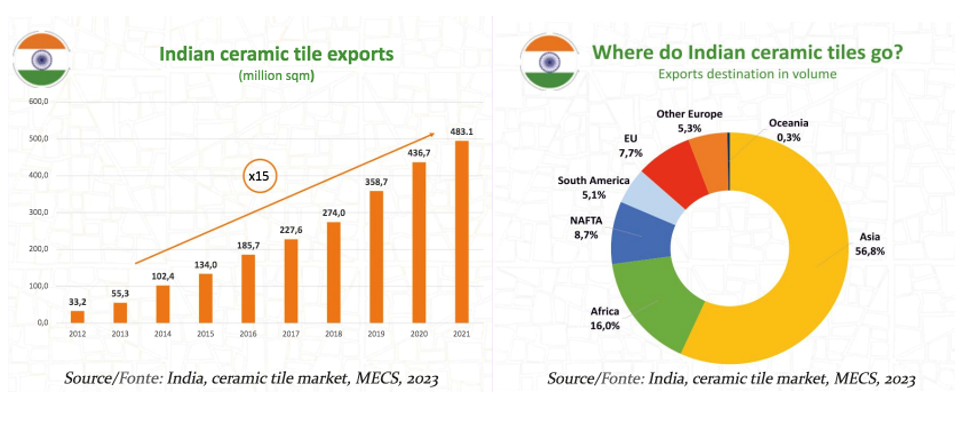

Actual production has increased through 2021 to 2.5 billion sq m, literally doubling since 2012, at a CAGR of 8.6 percent. In 2022 it is estimated to have slowed down due to soaring energy costs that caused several Gujarat producers to shut down kilns for a few months. There is, however, an endowment of more than 900 increasingly large and efficient production lines, which corroborates MECS study center forecasts that India will reach more than 3.7 billion sq m of production volume in 2026 (thus confirming year-on-year growth close to 8 percent), with domestic demand absorbing about 70 percent and exports set to exceed 1 billion sq m.

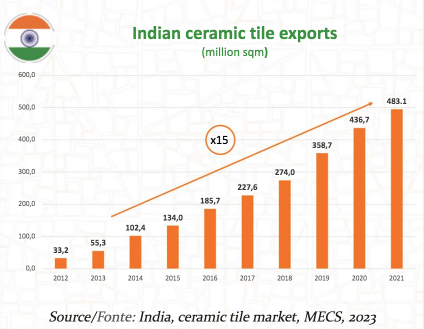

The latter has exploded in less than a decade, rising from just over 33 million sq m in 2012 to more than 483 million sq m in 2021, and continuing its dizzying run last year: leading Indian operators interviewed estimate that the export share has already reached 25 percent of total production and will soon exceed 30 percent. Much will also depend on the turmoil in the domestic construction market, whose investment, already up 18 percent in 2021 and 10.8 percent in 2022, is expected to exceed $500 billion this year and rise to more than $600 billion in 2025, twice as much as in 2010.

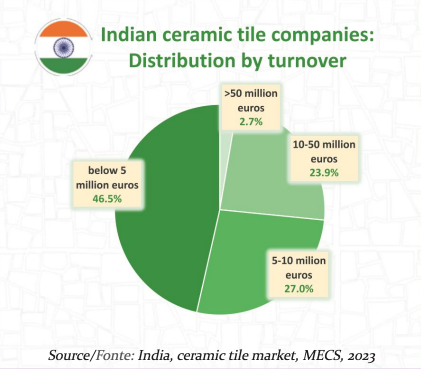

Finally, confirming the effervescence of market growth is the very large number of new ceramic companies, most of them SMEs under €5 million in turnover, making the supply hyper-flexible and dynamic.